Explain Why Performance Varies for Different Types of Acquisitions

Non-cash consideration may comprise vendor takebacks rolled equity earnouts. Identify and explain the corporate issues arising on an acquisition.

Pdf The Impact Of Organizational Culture Differences Synergy Potential And Autonomy Granted To The Acquired High Tech Firms On The M A Performance

PMBOK Phases are.

. Strategic aspects of acquisitions. Googles console for acquisition metrics allows organizations to determine whether their social campaigns search engine optimization efforts and paid advertising reflect in the behavior of site visitors. Benefits are the physical parts of a product.

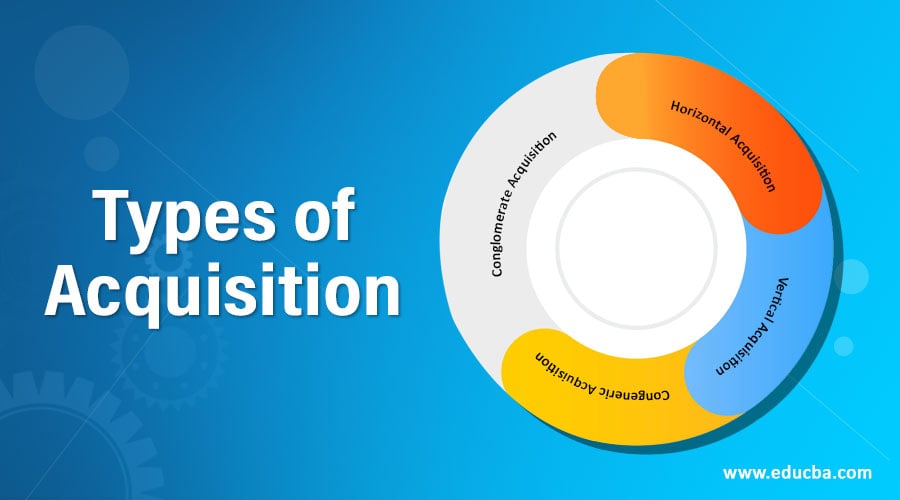

Or maybe a competitive threat compels a defensive move to get bigger faster. In a vertical acquisition the acquirer buys a company that is still in the same supply chain. MA Synergies MA Synergies occur when the value of a merged company is higher than the sum of the two individual companies.

Mergers and acquisitions MA is a general term that describes the consolidation of companies or assets through various types of financial transactions. 10 ways to estimate operational synergies in MA deals are. By combining a few different types of web analytics acquisition reports allow digital marketers to adjust strategies.

Its a tad different but is easier for some management teams to digest. The visual the kinesthetic and the auditory. Increased capabilities may come from expanded research and development opportunities or more robust.

Of the company into the non-cash and cash consideration components. A successful strategic alliance. This strategy gives advantages in increasing market power more significant market share and reducing costs economies of scale and economies of scope.

It may result in a gap in communication and affect the performance of the employees. Mergers and acquisitions MAs are the acts of consolidating companies or assets with an eye toward stimulating growth gaining competitive advantages increasing market share or. Mergers and acquisitions MA refer to transactions between two companies combining in some form.

Following are some of the various economic reasons. For example maybe an opportunity presents itself that requires fast decisive action. Although mergers and acquisitions MA are used interchangeably they come with different legal meanings.

Mergers and acquisitions take place for many strategic business reasons but the most common reasons for any business combination are economic at their core. Mergers and acquisitions make perfect sense in a variety of situations. On the other hand an acquisition is when a larger company.

A change of pace and a variety of learning techniques help to mitigate boredom and fatigue. You can learn more about financing from the following articles. Conglomerate merger horizontal merger market extension merger vertical merger and product extension merger.

In horizontal acquisitions the target company is their competitor. Initiate Plan Execute MonitorControl and Close. What Are Mergers and Acquisitions MA.

Differentiated marketing can be taken to the extreme with a practice known as one-to-one marketing. It is a good idea to try to appeal to all five of the learners senses particularly to those aspects identified by neurolinguistics programming. It is critical to the success of a core business goal or objective.

Synergy is two or more things functioning together to produce a. Relationship marketing is based on the belief that firm performance is enhanced through repeat business. Benefits are the only result of consumption.

The dominant rationale used to explain merging activity is that acquiring firms seek improved financial performance. Explain the arguments for and against the use of acquisitions and mergers as a method of corporate expansion. The following factors are considered to improve financial performance.

There are five commonly-referred to types of business combinations known as mergers. Here we discuss the top 4 practical examples of acquisitions like Amazon acquiring Whole Foods Market Microsoft LinkedIn Disney and 21st Century Fox etc. In an aggressive merger a company may opt to eliminate the underperforming assets of the other company.

The reasoning behind MA generally given is that two separate. It is critical to the development or maintenance of a core competency or other source of competitive advantage. There are many types of mergers and acquisitions MA be they a minority acquisition to explore a potential high growth emerging market a takeover of.

Your organization may have major phases similar to some major corporations that Ive worked at Initiate Define Design Build Test Production and Close. Evaluate the corporate nature of a given acquisition proposal in a scenario. The acquisition structure basically breaks down the enterprise value.

1 analyze headcount 2 look at ways to consolidate vendors 3 evaluate any head office or rent savings 4 estimate the value saved by sharing. Describe the competitive issues surrounding. The term chosen to describe the merger depends on the economic function purpose of the business transaction and relationship between the.

Differentiating the two terms Mergers is the combination of two companies to form one while Acquisitions is one company taken over by the other. It may result in employees losing their jobs. Acquisition structure is defined as the general framework or arrangement upon which the acquisition of a company will be organized.

MA is one of the major aspects of corporate finance world. The companies that have agreed to merge may have different cultures. In a merger two companies of similar size combine to form a new single entity.

Mergers and acquisitions MA are defined as consolidation of companies. Blocks a competitive threat. Here are five situations in which mergers and acquisitions have proven useful as a growth strategy.

Types Of Acquisition Top 4 Types Of Acquisition With Purpose

Chapter 9 Strategic Aspects Of Acquisitions

Pdf Success And Failure In Technology Acquisitions Lessons For Buyers And Sellers

Comments

Post a Comment